When tax season comes around, there is always the overarching question, “Should I do my taxes to save money?”

Since the streamlining of Turbo Tax and H&R Block, filing taxes for your business is right at your fingertips!

But is it the best choice for your business?

When business owners ask me if they should do their taxes, I focus on two key areas:

- the ACTUAL cost of DIY Taxes

- Their level of tax expertise

Let’s take a look to see which would be best for you!

#1 Doing Small Business Taxes on your own is NOT FREE!

Accountants and CPAs can vary in cost of services. But on the other end, doing taxes on your own…is not free.

The first question I ask business owners is, can you afford to hire a tax professional to do your taxes?

If you can afford it, I recommend that you outsource your taxes!

But what if you want to save money with DIY taxes (even though you can afford to pay someone)?

That is a great question! And my response is…Time is money, and it takes time to file taxes. Sometimes, you lose money when you file yourself.

“As a business owner, you can focus on hours that generate or save revenue.”

“So you have to ask yourself, “is the work I am doing worth the rate of return?”

Let’s be real! You would not work for free for an employer. And there is no such thing as working for free in your business. If you are working in your company without saving/making income, you are missing time that could be spent on more critical areas in your life, such as family and friends.

FREE HAS A PRICE and often, for small business owners, “working for free” is code for sacrificing precious time.

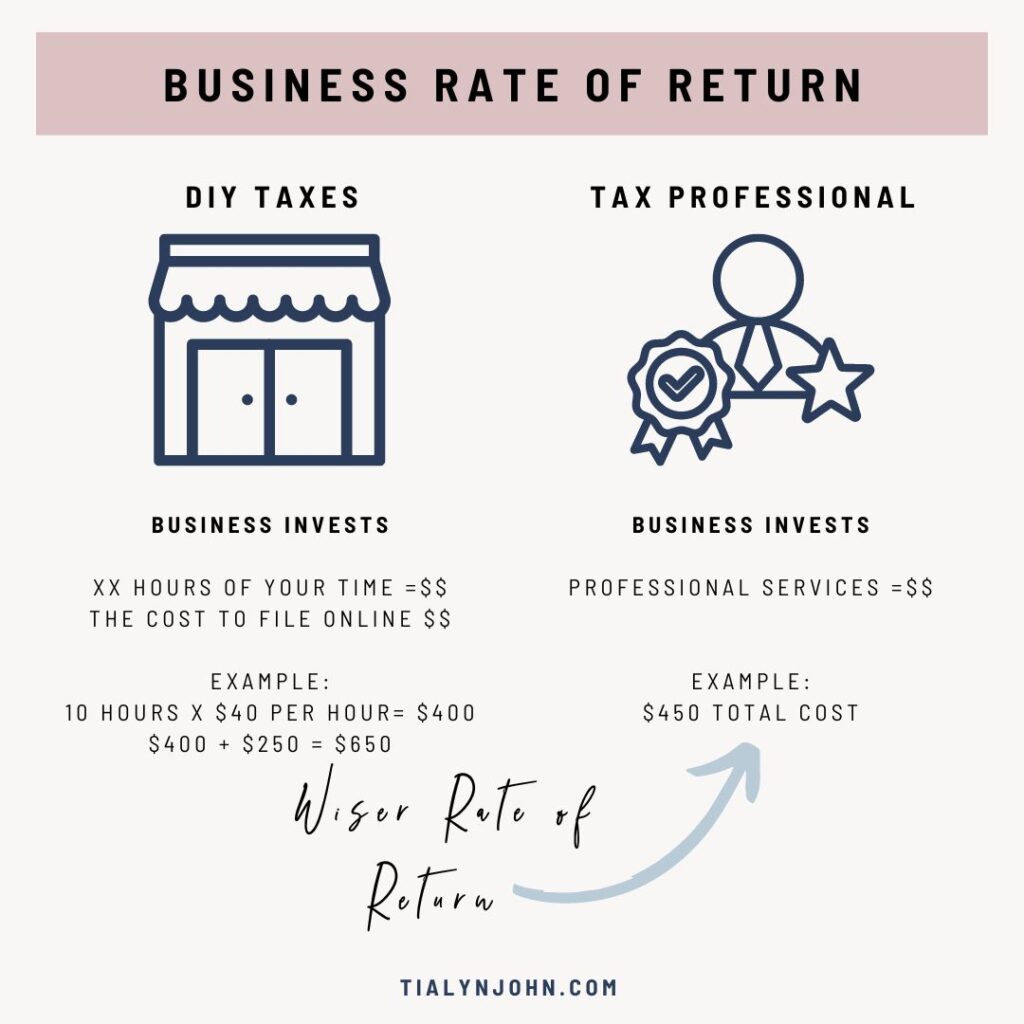

Let’s use the following for an example. (Please note these just random numbers to help you see visually how to calculate your rate of return)

Say you make, on average, $40 an hour when you work on tasks that generate revenue in your business. You estimate that it will take you 10 hours (from start to finish) to do taxes. After researching, you discover it will cost you $250 with online software to file independently. (Again random numbers).

Theoretically, considering your time and filing fees, $650 is the cost your business just invested for you to file your own taxes.

In the grand scheme of things, it only feels like you paid $250, which is why you justify filing your taxes on your own. However, it is wise to account for how much your time is worth to your business.

Because you sacrificed 10 hours to do your taxes, you lost 10 hours that you could have dedicated to income-generating tasks (or time with family and friends). So now we need to ask, was it worth it in this scenario?

To answer that, let’s dig a bit deeper.

Say you find an accountant who charges $450. You theoretically lost $200.

Let’s reshape our perspective!

Sometimes, we look at an accountant or CPA and think, “Their fee is expensive. I can save money if I do it on my own”. But in this scenario, when we consider what our time is worth, you are actually losing money by choosing to file your taxes on your own.

Which is why we look at our rate of return.

Ask yourself, could your hours completing your taxes be better spent elsewhere in your business? Could you take those 10 hours and apply them to generate additional income that not only pays for the tax professional but, also earns you more income OR more time back for what matters most?

What we just learned:

If you have the money to pay for a tax professional- and you will take a pay cut in how much you make per hour doing your own taxes to save money, then I recommend not doing your taxes. Instead, I would encourage you to hire a tax professional. Then, utilize the hours you would have spent filing your taxes and put that time towards projects/tasks to generate money for your business.

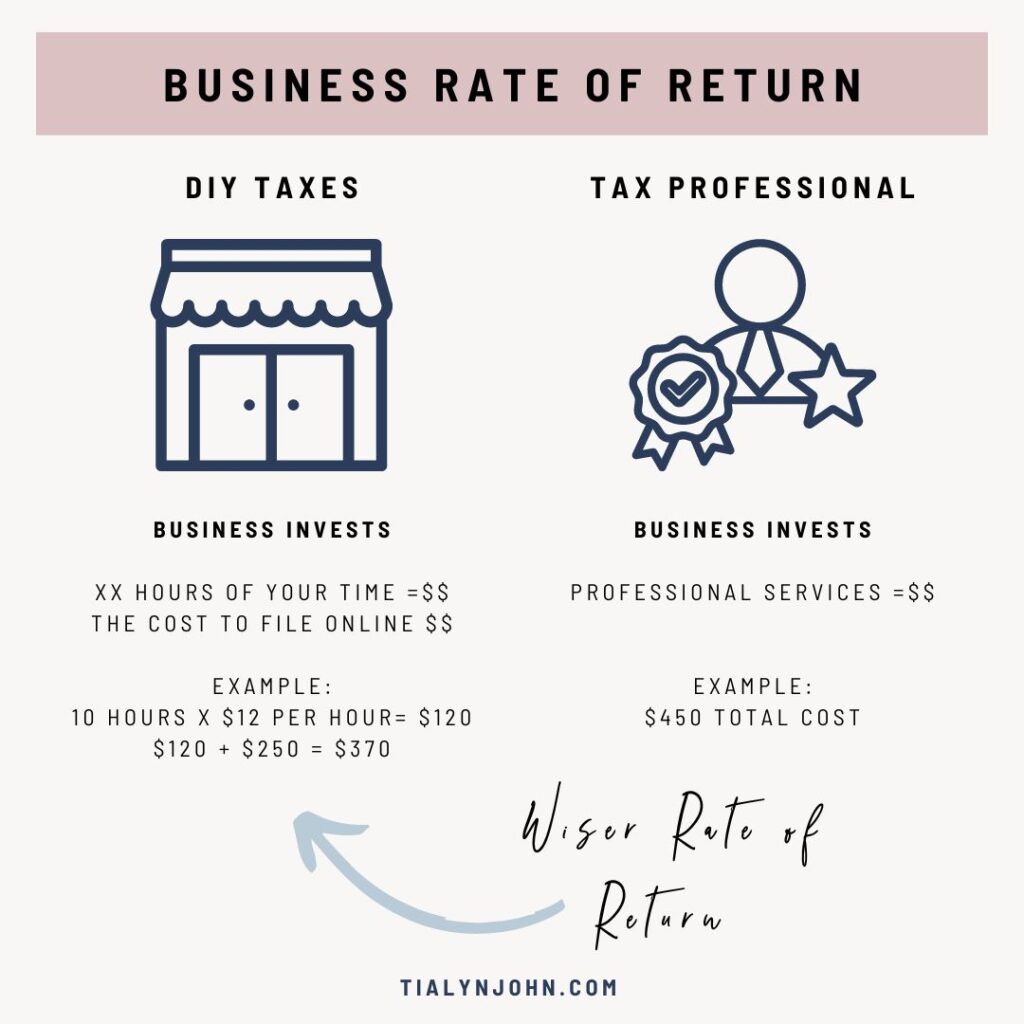

Now what if the opposite is true and you actually make a higher hourly rate when you file your own taxes…what does that scenario look like?

In the above visual the wiser choice AT THIS POINT is to do your own taxes. BUT DO NOT STOP HERE!

THE EXCEPTION to making enough money to hire a tax professional for your business taxes…but choosing to file your taxes on your own…

would be if you can say yes to all 3 of these statements:

- I would make more per hour by doing my taxes

- I am highly knowledgeable about tax laws and know that I am not leaving money on the table due to my extensive knowledge of taxes. (You are about to read this next)

- I enjoy doing my taxes. (If you do not enjoy it, and you can afford to hire…why are reading this post? Girl go hire someone!)

Alright if you are still with me and you can say yes to #1 & #3 above, let’s look more at #2!

#2 Filing taxes on your own does not mean that you are saving money.

In fact, you could be leaving more money on the table than you realize. Because you do not know…what you do not know!

If you know tax laws and understand deductions, you could save money by completing your taxes without a tax professional.

But do not underestimate what you do not know!

A lack of current/new tax laws can be costly in the long run! And it doesn’t have to be big glaring mistakes on your taxes that cost you money.

I once had a CPA have me fill out a form that cost me $65 to complete, and it saved me over $10k a year in taxes.

Fact! I never did my taxes incorrectly when I filed on my own. But I missed out on THOUSANDS because there were opportunities to save money that I was unaware of. Let’s say he earned his fee by knowing what I didn’t!

Again…You do not know what you do not KNOW. Not only have I learned this the hard way, but as a business coach, I see thousands of hard-earned money lost due to a business owner’s lack of knowledge in this area.

And that is the #1 reason WHY I recommend hiring a tax professional. A great tax professional will always look for ways you can save. Even if you know how to file your taxes (I filed mine on my own for years).

Sometimes, you save more money in your business by allowing experts in their field the opportunity to work for you.

It is easy to be defensive of our finances and not want to hire a professional for a task we can do. However..

not hiring a tax professional can sometimes cost you $$$$$.

So the real question should not be if you should do your taxes to save money, but instead, you should be asking, “Would hiring a tax professional be the wiser choice for my business?

Need a great tax professional? I found mine through Dave Ramsey’s Trusted Tax Pros.

Does tax season cause you stress? Check out the three tips I share with business clients on how to lessen stress during tax season.